Compounded annuity formula

The future value of a particular annuity with continuous compounding abbreviated at FVA is calculated using the following annuity. By doing this er is now elimated throughout the formula to now show The payment P in the formula directly above.

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

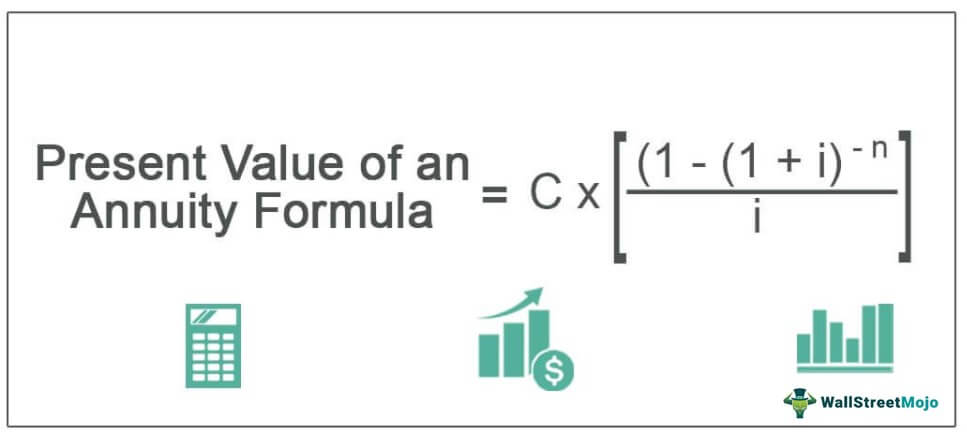

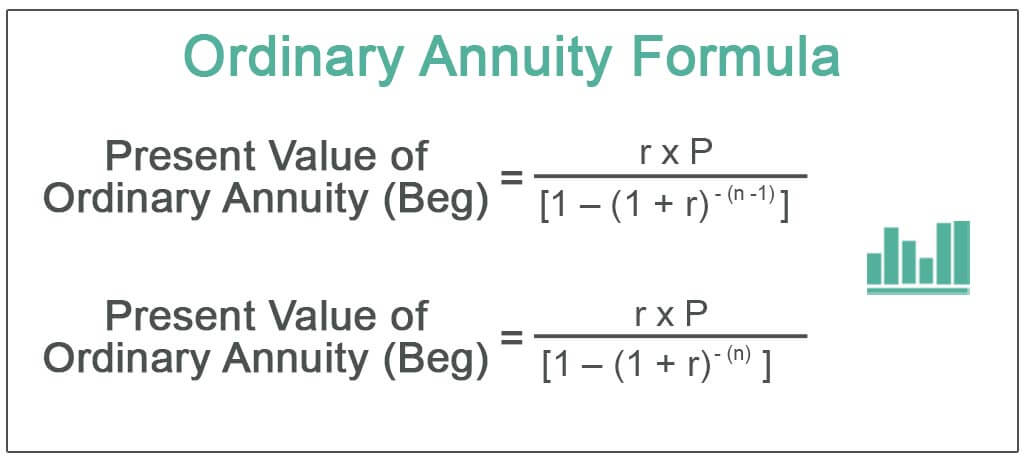

. Compounding and Discounting Annuities. Hence the formula is based on an ordinary annuity that is calculated based on the present value of an ordinary annuity effective interest rate and several periods. The interest on a loan or deposit calculated based on both the initial amount and previous interest payments from previous periods is known as compound interest or compounding interest.

Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by. Assuming you would like a formula for calculating compound interest. This can be derived using the below formula.

The annuity formulas are. A P 1 rnnt P principal amount the initial amount you borrow or deposit r annual interest rate as a. This video explains how to derive the value of an annuity formula using the case when deposits are made annually with interest compounded annuallySite.

Review How Income Annuity Payments Work How Soon Income Payments Begin. This equation can be multiplied by er er which is to multiply it by 1. Do Your Investments Align with Your Goals.

We can also calculate using table values of compound value factor of an annuity of Re. The formula can be expressed as follows. FV n Annuity Cash flow CVFA ni.

FV PV 1r n Where FV. Ad Learn More about How Annuities Work from Fidelity. It is important for an investor to know what is the total sum that the investment will have at its maturity.

Find a Dedicated Financial Advisor Now. An annuity is an equally spaced sequence of equal cash flows. Each cash flow is compounded for one additional period compared to an ordinary annuity.

1 also known as CVFAni table The formula is. Compound Interest Formula Annuity Formula FVPMT 1i 1iN - 1i where PV present value FV future value PMT payment per period i interest rate in percent per period N. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Annuities are particularly common in lending relationships such as car loans. Annuity formula continuous compounding. Ad Learn More about How Annuities Work from Fidelity.

FV of an Annuity Due FV of Ordinary.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

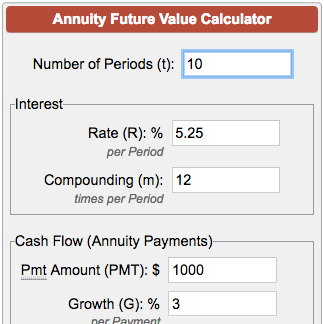

Future Value Of Annuity Calculator

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Future Value Of An Annuity Annuity Teaching Mathematics

Annuity Formula What Is Annuity Formula Examples

Present Value Of An Annuity How To Calculate Examples

Pv Of Annuity W Continuous Compounding Formula With Calculator

Annuity Due Formula Example With Excel Template

Ordinary Annuity Formula Step By Step Calculation

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Derive The Value Of An Annuity Formula Compounded Interest Youtube

How To Calculate The Present Value Of An Annuity Youtube

Future Value Of An Annuity Double Entry Bookkeeping

Future Value Of An Annuity Formula Example And Excel Template

Future Value Of Annuity Formula With Calculator

Fv Of Annuity With Continuous Compounding Formula With Calculator

Annuity Formula Annuity Formula Annuity Economics Lessons